property tax calculator frisco tx

Over 65 65th birthday 30000. Collin County Tax Assessor Collector Office.

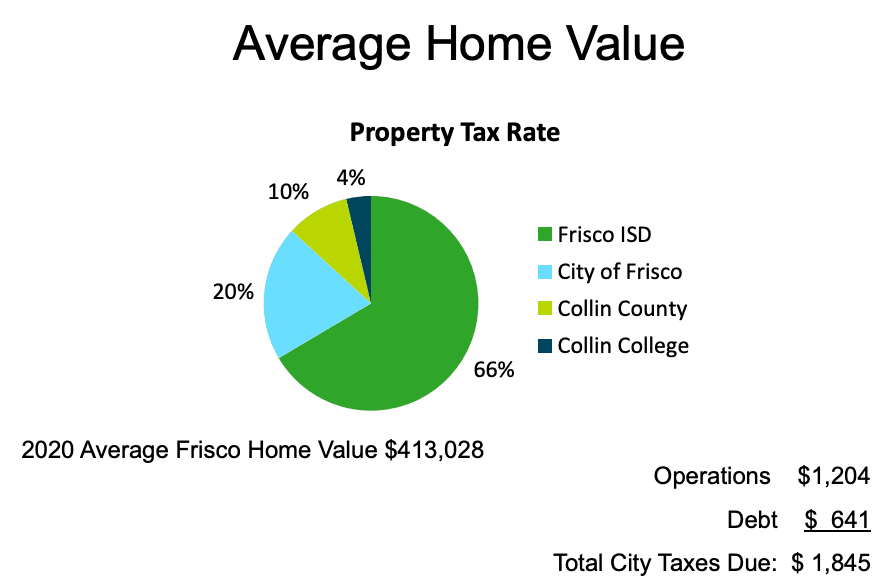

Property Tax Rate Comparisons around North Texas.

. Learn about Frisco Texas property taxes from Frisco Top Realtor and Frisco Luxury Home Realtor Real Estate Agent - What is my Frisco home worth. Skip to main content. Enter your Over 65 freeze amount.

Taxing entities include Frisco county governments. 6101 Frisco Square Blvd Suite 2000 Frisco TX 75034. Along with collections property taxation takes in two additional common functions.

Real property tax on median home. Enter your Over 65 freeze year. Sales Tax State Local Sales Tax on Food.

Creating property tax rates and directing appraisals. 6101 Frisco Square Boulevard. Property taxes are determined by what a property is used for.

Calculate your Collin County property tax amount for each taxing unit that applies. Our Texas Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average. Taxpayer Rights Remedies.

Real property tax on median home. Property Tax General Information PDF Resources Forms. A Comparison of North Texas Property Tax Rates based on City Schools and Counties.

Property taxes in America are collected by local governments and are usually based on the value of a property. Sales Tax State Local Sales Tax on Food. For more information call 469.

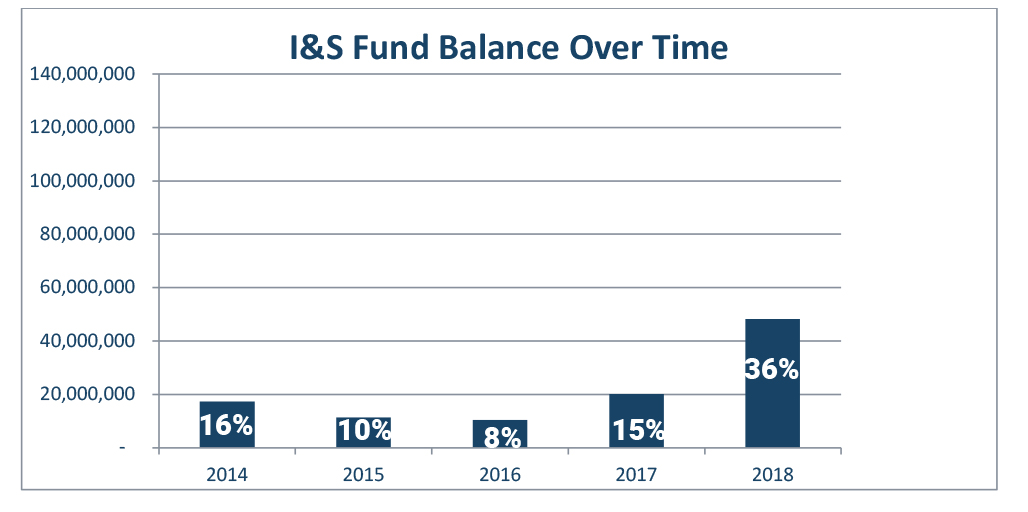

For comparison the median home value in Texas is 12580000. The latest tax rates can be found for Collin County citytown school district community college and special. With the help of this recap youll get a practical perception of real estate taxes in Frisco and what you should take into consideration when your payment is due.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. If you are considering becoming.

Living In And Moving To Frisco Tx Is Frisco A Good Place To Live

Dallas Dfw Property Tax Rates H David Ballinger

8449 Biscayne St Frisco Tx 75035 Mls 20033920 Zillow

U S Cities With The Highest Property Taxes

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Frisco Recommends Raising Property Taxes Texas Scorecard

Texas Property Tax Calculator Reform Austin

How To Calculate Property Tax 10 Steps With Pictures Wikihow

City Of Frisco Tx City Hall Frisco Keeps Property Tax Rate Same For Fifth Consecutive Year Fy22 Budget Provides For 47 New Positions For The Fifth Consecutive Year The City

Despite Lowered Tax Rate Average Tarrant County Property Owner Will See Their Bill Increase In Coming Year The Texan

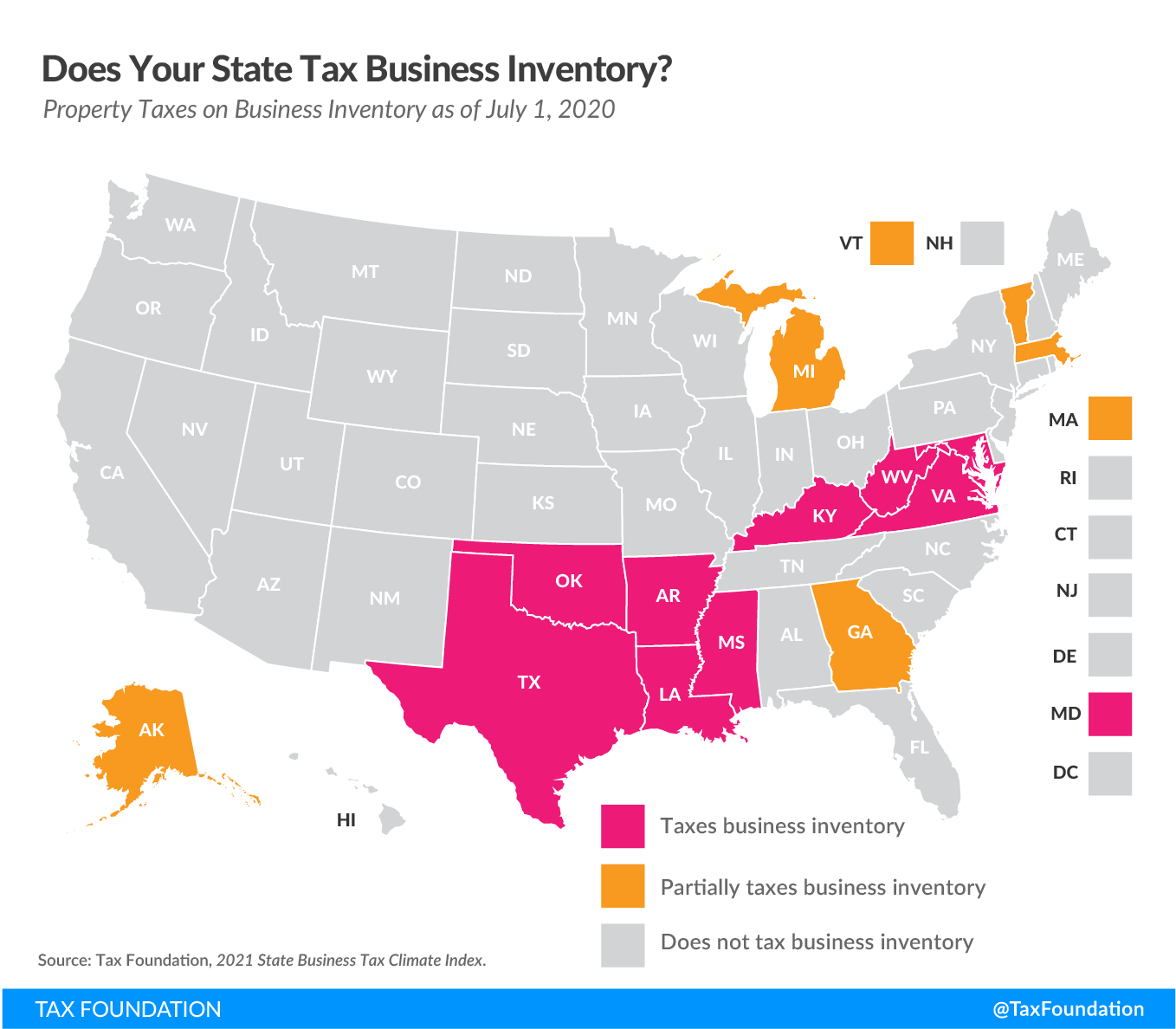

Does Your State Tax Business Inventory Tax Foundation

How Property Taxes Are Calculated

Mckinney City Council Lowers Property Tax Rate

Frisco Officials Look For Compromise On Tax Caps Community Impact

Frisco City Council Approves Homestead Exemption Increase Property Tax Freeze For Elderly And Disabled Residents Community Impact

Fort Bend County Ranks Very Low Among Places Receiving The Most Value For Their Property Taxes